Disabled passenger vehicles. Get more information on vehicle tax exemption. To find a Post Office branch, you can either: use the Post.

Check the eligibility criteria for historic vehicle tax exemption and how to apply to stop paying for vehicle tax in the United Kingdom. That means you do not have to pay it. Are vehicles exempt from tax? Can I claim my car tax exemption?

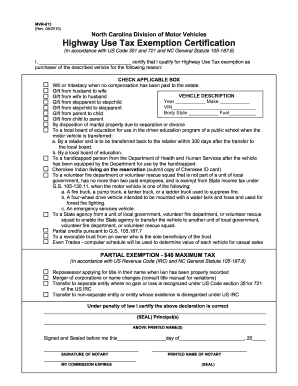

When is a vehicle tax exempt? To claim the exemption or reduction the vehicle must be : Registered in the disabled person’s name or their nominated driver’s name. It must be only be used for the disabled person’s personal needs. Zero-emission cars (such as electric vehicles) are exempt from car tax.

If your car cost more than £40when bought new, you have to pay an extra £3per year for five years, on top of the standard rate. This includes existing owners. Is my vehicle exempt from vehicle tax ? Wondering if anyone can help me out.

I’m elegible for vehicle tax exemption , but I can’t figure out for the life of home how to claim it. I can either claim when I pay for the vehicle tax or that I can register with the post office and by post. Using the vehicle in the disabled tax class The vehicle must either be used by the disabled person or someone who only uses their vehicle to help them, for example, to get prescriptions or go shopping for the disabled person.

Driving tests and learning to drive or ride. If the exemption no longer applies If you don’t use the vehicle as described above or the disabled person is no longer. Vehicle tax , MOT and insurance. How do I apply for vehicle tax exemption ? Apply at a Post Office that deals with vehicle tax. The Post Office sends your log book to DVLA.

It can be anything up to £0or more a year, depending on how environmentally-friendly the car is. Even if no fee is require should the car be exempt, you must still re-tax the vehicle every year. From May 2 when you tax your classic – either online with the Vor reminder letter, or at the Post Office – you can declare the vehicle as MoT exempt once it is beyond the 40th anniversary date of first registration. Car tax is no longer transferrable when you buy or sell a vehicle. There are no exceptions to this, which means that to legally drive home the car you’ve just bought, you need to tax it.

If you are a disabled driver, you may get an exemption from paying Road Tax. The historic car tax exemption is updated to include more cars each year (Image: Getty) On April each year vehicles constructed more than years before the January that year will. Note that this isn’t an automatic process and the exemption needs to be applied for.

In this instance, it applies to the vehicle’s production date rather than the date of first registration – an important point to bear in mind if you can prove that your particular car sat unregistered for a year or two before hitting the road for the first time. GENERAL INFORMATION. K views Chorlie Forumite.

Alternatively you may be entitled to relief from a certain amount of VRT. More extensive VRT information is given in the Exemptions and Reliefs manual. Renew your vehicle tax exemption.

Tax your car , motorcycle or other vehicle using a reference. To get an exemption , they must have a maximum speed of 8mph when used on the road. You do not need to pay. They should also have a device fitted that limits them to 4mph if used on footways to be road tax exempt. Their qualification for exemption took place.

Do you qualify for a tax exemption? Can disabled person claim car tax exemption? MOT certificates help to ensure that all the vehicles on the road are safe to drive. Among other problems, an MOT test will check for any wear and tear to your vehicle ’s engine, exhaust system and key areas of its body.

It means any vehicle built or more years ago will be exempt from car tax on an automatic rolling basis on April each year. Which vehicles are exempt from paying car tax ? People who don't hold a blue badge may also qualify for the road tax exemption. Many blue badge holders are eligible for exemption from vehicle excise duty (road tax ) on grounds of disability.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.