Can I check if my car is insured? How do you check car insurance after a traffic accident? Is check on askmid proof of insurance? You must have insurance before you can use your vehicle on the road. Browse: Vehicle tax, MOT and insurance Popular services.

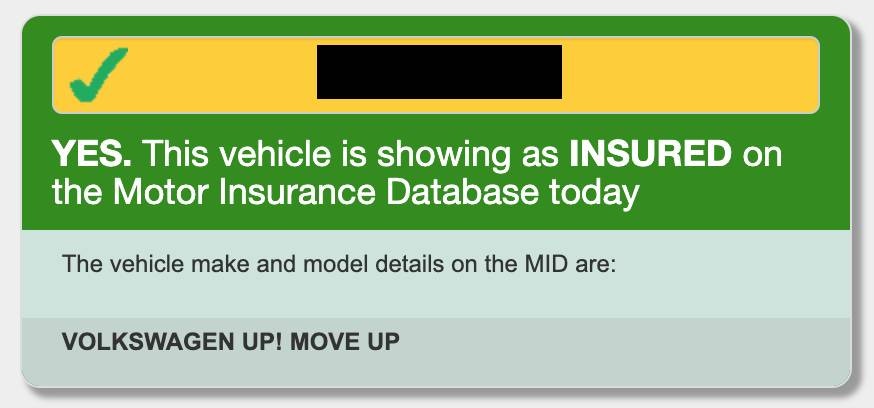

Using the MID (Motor Insurance Database) to check your vehicle has a valid insurance policy and to check the insurance details of the other parties involved after a road traffic accident. Use askMID to check your vehicle. Check a vehicle at the roadside after an accident. Third party insurance is the legal minimum.

This means you’re covered if you have an accident causing damage or injury to any. Use the “ Check My Vehicle ” button below if you own the vehicle you wish to enquire about. The service is FREE to the owner of the vehicle. Is Another Person’s Car Insured? If you want to check the insurance status of someone else’s vehicle , please scroll down to the “ Check Other Vehicle ” button.

You will also still have to pay for your insurance on top of any fines received. You can check if your vehicle is insured on askMID. Find out which insurance group your car is in.

Every car in the UK is allocated an insurance group to help insurers work out the cost of cover, running from (cheapest premiums) to (highest). Key in your reg to find out where your car sits. Enter your registration to find out where your car sits. Check your bank or credit card statements for payments to an insurance company.

Then you can try to contact them for. Specialist Insurance Tailored to You. View ERS Insurance policy documents here or get an insurance quote online. As long as you (or your legal representative) know the date of the accident, the registration details of the other vehicle and your information, the MID offers an alternative service.

A check after the event currently costs £4. Use the online service askMID to check your vehicle has a valid insurance policy. The MID (Motor Insurance Database) is the central record of all insured vehicles in the UK. Managed by the MIB, the MID is used by the Police and the DVLA to enforce motor insurance law - ensuring that vehicles driven on our roads are insured at all times.

If it has been a while since you made a claim, there are ways to check the details of your claims history. How can I check my car insurance claims history? You have a couple of options for checking your car insurance claims history. The easiest option is to request your claims history directly from your current car insurance provider. Enter the registration number (number plate) to get an instant free vehicle check on the screen.

One of the most important checks you should carry out before purchasing a used car is an insurance write-off check. In the UK we describe a car as ‘written-off’ after it has been in an accident and suffered damage. Sometimes the damage is too severe, or the repair costs will far exceed the car’s current value, and it is “scrapped”.

An easy way to check whether your vehicle is insured is through the Motor Insurer’s Database (MID) online. The easiest way to find out if your car is insured is to check your registration number against the Motor Insurance Database (MID). This is a national register of all the cars insured in the UK. The search is free to run, with a small fee for additional details like the insurance provider’s name and general policy details. How do I find out if my car insurance policy has expired?

Call your insurer if you know who it is and ask about the details of your policy Check your own records to see if you’re currently paying for an insurance policy Look through your bank or credit statements for any outgoing payments Search. Registration number (number plate) For example, CU57ABC.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.