You do not need to be the vehicle ’s registered keeper to set up a Direct Debit. Emails and letters about. The vehicle keeper must have a vehicle logbook (V5C) before. The Direct Debit will also be cancelled if you no longer. Ask your bank or building society to cancel your Direct.

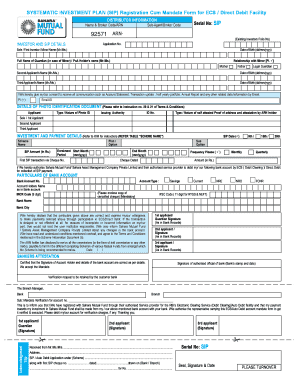

Tax your vehicle on the first day of the month that your. Paying vehicle tax by Direct Debit offers you the. You can pay your vehicle tax by Direct Debit – either online. Set up, change or cancel your car tax Direct Debit , swap to. There are several reasons why the DVLA will cancel a vehicle tax Direct Debit.

It will get cancelled if you tell them that the vehicle got: Sold or transferred to another person or organisation. Taken off the road using a Statutory Off Road Notification (e.g. kept in a garage). What is car tax direct debit? Vehicle Tax Direct Debit Guidance on paying vehicle tax by direct debit using the new online system. Can I pay my vehicle tax by direct debit?

Can direct debit be cancelled? Can I continue driving after direct debit payment? Although car MOTs have been extende car tax (VED) must still be paid.

A car tax refund does not apply to: Any fees charged to a credit card. The surcharge fee of applied to some vehicle tax Direct Debit payments. First Tax Payment Refund. The amount that you can get back is based on the lower of: The first tax payment when you registered the vehicle.

Obvs I cannot get one. You can cancel your vehicle tax by informing the DVLA if you have sold it or declared it off-road. If you have already paid some tax , you’ll automatically be eligible for a refund- this will arrive by cheque and is calculated from the date that the DVLA receives the information. Your road tax will be cancelled by DVLA.

If you pay by Direct Debit , this will be cancelled automatically and you’ll get a refund cheque for any full months left on your vehicle tax. The refund is calculated from the date DVLA gets your information. If you choose direct debit , payments will continue automatically for as long as you hold a valid MOT, or until you cancel the direct debit or inform the DVLA that you no longer have the car. However, be aware there is a charge for paying monthly or six-monthly.

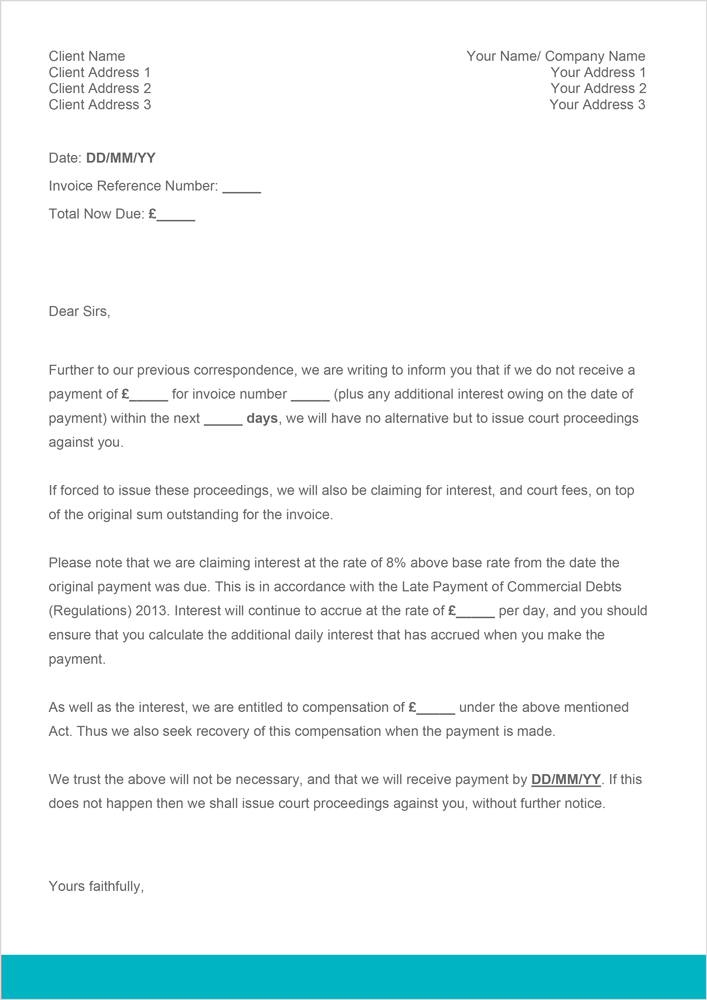

Use our branch finder tool to find where. Threatening a £0fine for unpaid vehicle tax , the message encourages drivers to update their billing details via a phishing website link - giving criminals direct access to your bank details. New figures reveal that 16. Direct Debits have been set up to pay for vehicle tax in the UK, two years since the option was first introduced by the Driving and Vehicle Licencing Agency (DVLA). I expected them to cancel it once they acknowledge the sale, and didn't want to cancel it too early myself to avoid some sort of a possible penalty or whatever you do (you are often warned by banks at Direct Debit cancellation that other party must be informed etc).

Direct Debit for car tax on old vehicle however still came out at the beginning of June and also July. I had set up a direct debit last October, so today checked with my Natwe. Hi,im selling my car on the 30th of march,i was wondering how does the new owner avoid having to pay an additional months tax ? Im paying it by direct debit monthly.

Should i just keep it going until the end of the month and then cancel my direct debit and then tell them to buy a tax disc then? Will it be alright for them to drive with my tax.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.